For occasion, it takes into consideration transaction fees, thus lowering prices for traders. By intelligently deciding on the right venue, SOR can reduce transaction prices whereas maximizing the probability of favorable execution, ultimately serving to traders execute orders faster and with improved results. Market maker routing is the default setting for orders positioned in the app and on web traditional. With market maker routing, Robinhood Crypto sends your order to a number of market makers, which compete with one another for execution. As of December 18th, 2024, for every $100 of notional crypto order quantity executed through market maker routing, Robinhood Crypto receives $0.60 in rebates from its market maker. This optimization not only enhances execution high quality but also minimizes trading prices.

Signal Up To Check Lcx Sensible Order Free Of Charge

If extra liquidity is needed to execute an order, sensible order routers will post day restrict orders, relying on probabilistic and/or machine learning fashions to search out the best venues. If the targeting logic supports it, baby orders can also be sent to darkish venues, although the consumer will sometimes have an choice to disable this. Decentralization and privacy are the core rules of cryptocurrencies. There are many platforms aimed at maintaining your transactions anonymous, and choosing one that best suits your preferences is essential. Resolve what you actually need from the platform, examine its privacy requirements and history of hacks.

With low latency, high-speed execution, and cross-asset help, together with equities, choices, and futures, it ensures environment friendly trading. Access to Instinet’s proprietary darkish swimming pools like BlockMatch, and integrated Transaction Cost Analysis (TCA) instruments improve execution high quality. Moreover, robust compliance options and international connectivity provide a comprehensive solution for achieving optimal trade execution and regulatory adherence. Implementing smart routing in crypto exchanges offers significant advantages, together with cost efficiency, optimized liquidity, and improved buying and selling performance.

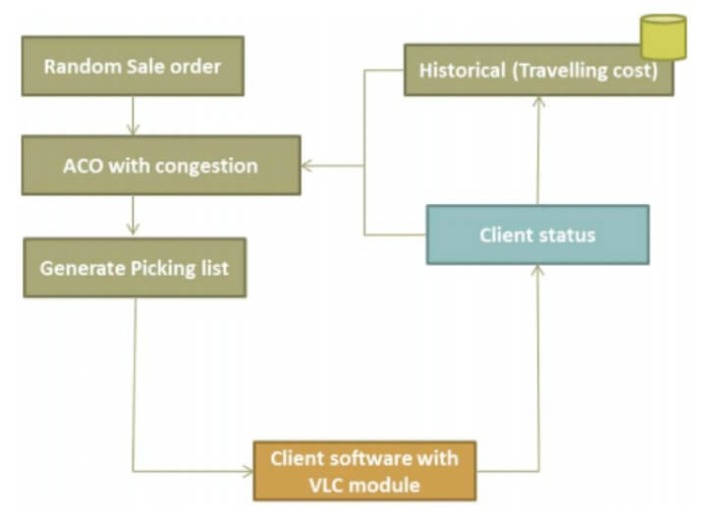

With expertise in building progressive trading platforms, Shift provides state-of-the-art enterprise change software program, ensuring an easy and successful transition into the world of derivatives trading. Take the following step with Shift Markets and revolutionize your change providing today. When a trader order comes through, a sensible order router will ideally scan for all potential execution alternatives and can then execute at the most effective worth after deciding on a specific strategy. By taking into consideration several parameters corresponding to value, price, volatility, position, venue desire, stage of market depth, etc., a trader can construct their execution strategy to handle or mitigate potential dangers. The circle graph highlights factors such as market latency, transaction costs, liquidity, and venue velocity. Every section of the graph represents a different factor, illustrating their impression on SOR effectivity.

- With over 14 years of expertise, Quod Financial delivers strong danger controls and regulatory adherence, guaranteeing compliance and safety.

- RHF, RHY, RHC, RCT, RHG, RHD, and RHS are affiliated entities and wholly owned subsidiaries of Robinhood Markets, Inc.

- A Wise Order Router analyses all out there buying and selling venues in real-time and selects the one that offers the very best execution for an order.

- The algorithms driving SOR require constant evaluation of worth, liquidity, and venue efficiency.

In the dynamic trading landscape of 2025, sensible order routing (SOR) is an important device for contemporary financial markets. By leveraging SOR, exchanges and brokers achieve finest execution, improve trading efficiency, and unlock access to deeper liquidity. This positions them as leaders in today’s highly aggressive surroundings. The concept of SOR emerged in response to the growing fragmentation of monetary markets. With a number of exchanges and various buying and selling techniques, there’s typically significant variation in pricing throughout venues.

It analyses market information, order details, and costs in real-time, and on an order-by-order foundation. The SOR effectively performs a pre-trade transaction price evaluation, contemplating liquidity, dealer fees, venue taxes, velocity of execution, and settlement to drive the order routing process efficiently. Order Routing is the method by which brokerages direct purchase and sell https://www.xcritical.com/ orders from buyers to various trading venues. Order routing ensures that trades are executed efficiently and at the finest possible prices. Effective order routing strategies are important for optimizing trade execution, minimizing prices, and maximizing returns for traders and traders. Smart Order Routing is a game-changing technology in today’s buying and selling setting, allowing traders to achieve optimal results by leveraging multiple buying and selling venues.

Step-by-step Process For Implementing Good Routing

The technology presents several advantages, together with improved value discovery, reduced slippage, and decrease execution costs, while also presenting certain challenges corresponding to latency and complexity. With rapid advancements in AI, machine studying, and blockchain know-how, SOR will continue to evolve, shaping the future of buying and selling across various financial markets. SmartTrade Technologies’ Smart Order Routing performance optimises trade execution by intelligently directing orders in accordance with finest execution principles and whole price of trading analysis. Utilising real-time information and advanced AI algorithms, SOR evaluates a quantity of elements corresponding to price, liquidity, and latency to make sure optimum trade execution. This dynamic approach reduces transaction prices and minimises market impact, benefiting both buy-side and sell-side establishments. A main European bank recently deployed smartTrade’s SOR to reinforce its FX buying and selling operations, reaching a big enchancment in execution quality and operational efficiency.

Liquidity One Hundred And One: Understanding The Backbone Of Economic Market

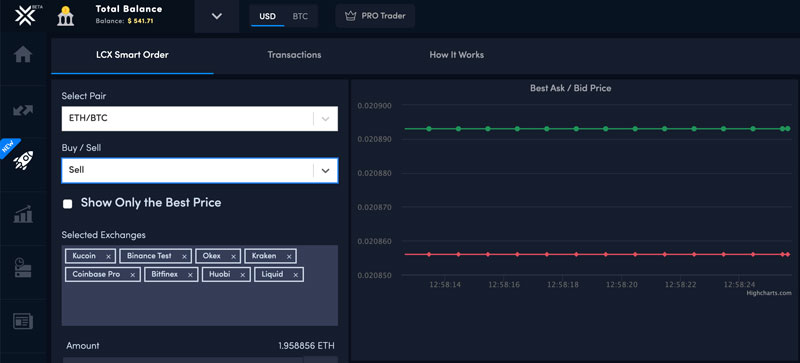

By analyzing elements like bid-ask spreads and order depth, SOR guarantees merchants achieve the very best outcomes. LCX Good Order helps you deploy real-time buying and selling strategies instantly throughout any mixture of markets and exchanges. LCX’s good order routing system is an easy-to-use platform, integrating industry-leading charting instruments and superior order administration features. The following teams of customers can significantly profit from utilizing it in their day by day trading activities. The benefits of Smart Order Routing embody mechanically looking for the very best value, lowering slippage and increasing trading effectivity. Smart Order Routers assist institutional and personal merchants obtain one of the best costs and lowest prices.

The way ahead for smart order routing lies in its steady technological evolution, pushed by developments in AI, machine learning, and blockchain integration. These innovations are redefining trade execution and market efficiency, making platforms more competitive and adaptive. SOR routing accommodates numerous buying and selling needs, from simple retail orders to complicated institutional methods Stockbroker. Its adaptability ensures environment friendly operations across a number of asset lessons and market varieties.

By utilizing superior algorithms, Good Order Routers make sure that orders are mechanically forwarded to the execution venue with the best circumstances. Particularly in markets with excessive liquidity and volatility, Good Order Routing allows you to implement your individual buying and selling methods in the very best means. For institutional merchants and brokers, using Smart Order Routing is subsequently essential so as to stay aggressive and obtain one of the best outcomes for his or her clients.

Brokerage providers are provided by way of Robinhood Monetary LLC, (“RHF”) a registered dealer vendor (member SIPC), and clearing services via Robinhood Securities, LLC, (“RHS”) a registered dealer dealer (member SIPC). You’ll be charged a percentage fee (minimum $0.01) on the greenback value of the executed quantity. 0.02% of the charge goes to the partner exchange and the rest goes to Robinhood Crypto. Create a new wallet, backup your recovery phrase offline and use DEXs like Uniswap to swap tokens without KYC. As for StealthEX, go to its official website, select the cash you need to change, enter your receiving pockets address and full the swap. This means that customers can trade, deposit and withdraw up to 1.5 BTC day by day without identity verification.

Estudiante y escritora independiente que cubre una gran cantidad de temas como astrología, horóscopo, estilo de vida, moda, viajes y mucho más.

Me apasiona explorar las conexiones entre las estrellas, los números y nuestros viajes espirituales. A través de artículos perspicaces, comparto cómo estas prácticas ancestrales pueden ofrecer orientación, claridad y autodescubrimiento.