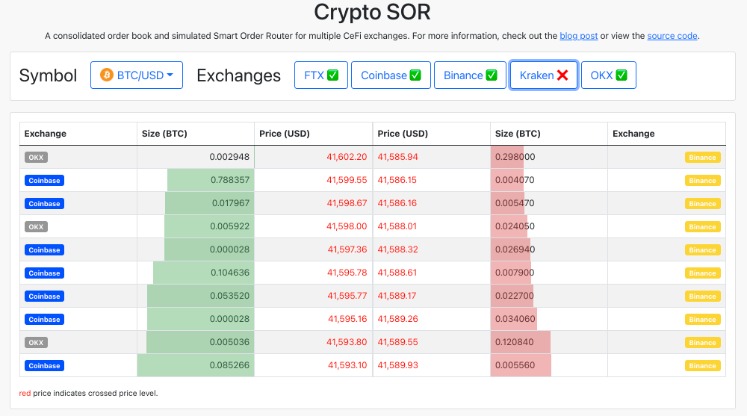

Depending on elements like order book depth, quantity, and worth fluctuations, it splits orders throughout exchanges, dark swimming pools, and different venues. This routing method is particularly beneficial for high-frequency traders (HFT) or traders operating in unstable markets where prices expertise speedy actions. By decreasing execution latency, this approach permits orders to be fulfilled earlier than market conditions change considerably, providing traders a aggressive benefit in swiftly evolving markets. If market conditions change (e.g., a better price or liquidity becomes out there at another venue), smart order router software program may regulate the routing technique mid-trade to make sure the best end result. The launch of the primary good order router was a revolution in buying and selling, permitting merchants to entry liquidity throughout multiple markets and get dimension carried out. Unbiased smart order routers addressed intermarket linkages years earlier than regulatory adjustments made this a requirement.

This ends in improved fill prices because the sensible route searches for the best fill costs concurrently. Smart order routes can simplify the order routing course of and are preferred by many new merchants and lively traders. Smart routes are an efficient and straightforward way to utilize order routing for self-directed traders. This methodology involves sending the order to the venue where it can be promptly executed, thereby minimising the potential for worth fluctuations or delays.

Fixed-income Trading Tech Panel Discusses Bond Data, Liquidity And Protocols

If the focusing on logic helps it, child orders may also be sent to dark venues, although the shopper will sometimes have an choice to disable this. Routing primarily based on predetermined situations or triggers, such as price targets or quantity thresholds, defines this type of routing. The order is routed and executed solely when particular standards are happy, enabling a more strategic strategy to execution. This method aids in preserving price stability through the execution of enormous trades, thereby decreasing slippage and shielding the order from unfavourable market responses. This approach is particularly helpful for institutional merchants who should execute substantial orders discreetly with out causing important market actions.

Challenges And Considerations In Sor Implementation

One of those is latency, which is the delay within the forwarding and execution of orders that may happen due to the processing pace of the system. One Other drawback is the splitting of orders, the place giant orders are split between a number of exchanges, which can not at all times result in optimum execution. AI is not on the horizon – it’s embedded in the infrastructure of contemporary capital markets. But separating real impact from inflated guarantees requires a grounded, sensible understanding.

- When executing cross-border funds, SOR can find the optimal overseas change charges across multiple liquidity providers, guaranteeing that multinational firms minimise transaction costs and trade price threat.

- By intelligently routing orders to essentially the most appropriate execution venue, TORA helps purchasers achieve higher execution, reduce buying and selling costs, and enhance general buying and selling performance.

- An instance that highlights the effectiveness of SOR algorithms is the case of a big mutual fund looking for to buy a considerable number of shares in a blue-chip firm.

SmartTrade Technologies’ Sensible Order Routing performance optimises commerce execution by intelligently directing orders based on best execution principles and total cost of trading evaluation. Utilising real-time information and superior AI algorithms, SOR evaluates a quantity of components such as value, liquidity, and latency to ensure optimal trade execution. This dynamic strategy reduces transaction prices and minimises market impact, benefiting each buy-side and sell-side establishments. A main European financial institution recently deployed smartTrade’s SOR to enhance its FX buying and selling operations, attaining a major improvement in execution high quality and operational efficiency. By constantly adapting to market situations, smartTrade’s SOR offers a competitive edge within the low latency FX market.

Right Here, the SOR is employed to pinpoint advantageous trading opportunities within dark pools, allowing for the execution of trades with minimal impression available on the market. Shopify’s smart order routing is a robust device that can allow you to optimize your success process, scale back delivery prices, and ship products faster to your prospects. By automating the success course of across multiple locations, your corporation can scale extra easily, while still sustaining control over your success operations. Smart Order Routing is a classy expertise that performs a crucial position in fashionable trading. It embodies the intersection of finance and know-how, where algorithms not solely execute trades but in addition embody a technique that aligns with the dealer’s objectives.

The most common route among low cost, regular, and full-service brokers is thru market makers, often in-house or outsourced to third party via order circulate preparations. Market makers and specialists work the orders sent to exchanges like the NYSE, NASDAQ, and AMEX. If you’re a dealer utilizing a day buying and selling platform, you want to have the power to route your orders. However, an easier way to handle the order routing is through the use of the sensible order routing, which most day trading brokers present for clients. Sensible order routing allows manufacturers to automate the process of selecting a location from which to ship orders to their purchasers.

Charles River Growth (CRD), a subsidiary of State Avenue Company, offers superior Smart Order Routing performance within its comprehensive Investment Administration Resolution (IMS). The SOR system is seamlessly built-in with CRD’s algorithmic buying and selling tools, enabling the use of advanced buying and selling methods tailored to particular execution targets. Merchants can customise execution strategies by setting parameters corresponding to restrict costs, time constraints, and most well-liked venues, making certain orders are executed to fulfill strategic and compliance necessities. With connectivity to a broad array of buying and selling venues, CRD’s SOR ensures entry to one of the best out there liquidity and pricing choices. Moreover, the platform supplies sturdy post-trade analytics and reporting, offering detailed insights into execution quality, market impression Cryptocurrency wallet, and slippage, which help traders refine their methods and improve outcomes.

Sensible Order Routing (SOR) techniques characterize a big advancement within the buying and selling panorama, providing a classy means to navigate the fragmented nature of contemporary monetary markets. These techniques harness algorithmic methods to investigate a quantity of factors similar to price, liquidity, and transaction costs throughout various trading venues to determine the optimum path for order execution. The goal is to achieve the absolute best execution for trades, which is a multifaceted idea involving not simply the price of the asset but also the speed and chance of execution, in addition to the overall impression on the market. Upon receiving the order, the sensible order routing algorithms promptly process real-time market data from various trading venues, together with inventory exchanges, darkish pools, alternative trading systems (ATS), and liquidity providers. It carefully assesses a spread of factors, similar to bid-ask spreads, available liquidity, trading volumes, and execution velocity.

Retailers will profit from greater inventory oversight and extra sustainable shipping practices. In The Meantime, decrease transport charges and quick supply options will improve customers’ loyalty in the lengthy run.Want to be taught more about our versatile order management system? For massive orders, algorithmic buying and selling firms use SOR to interrupt orders into smaller items and execute them throughout a quantity of venues, minimising their market impact and lowering the chance of value movement.

This foundation establishes a resilient platform that may scale and adapt effectively to excessive volumes. As market volatility exhibits https://www.xcritical.com/ no signs of slowing, this providing permits brokers to source liquidity from their algos to handle the substantial progress in buying and selling volumes. News and assets on capital markets, exchanges, commerce execution and post-trade settlement. For example, when you have both warehouses and storefronts, you may want to prioritize your warehouse areas over your storefronts.

自出生以来,我一直感觉到自己与神灵有着紧密的联系。作为一名作家和导师,我的使命是帮助他人在最黑暗的时刻找到爱、幸福和内心的力量。